what are roll back taxes in sc

Out of a 10 acre tract 2 acres are sold. They are based on the difference between the tax paid and the tax that.

Dorchester County Mailing Property Tax Bills News Notices Dorchester County Sc Website

Download This Bill in Microsoft Word format Indicates Matter Stricken Indicates New Matter.

. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment. Please fill in all yellow areas and select the Calculate button. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment.

The Rollback tax is a requirement codified in South Carolina state law. Rollback Tax Explanation PDF Agricultural Use. An act to amend section 12-43-220 code of laws of south carolina 1976 relating to classification of property and assessment ratios for purposes of ad valorem taxation so as.

The Assessors Office will facilitate the estimate of Roll-Back Taxes that. To amend section 12-43-220 as amended code of laws of south carolina 1976 relating to classification of property and assessment ratios for purposes of ad valorem. SC Code of Law Section 12-43-220 4 When real property which is in agricultural use and is being valued assessed and taxed under the provisions of this article is applied to a use other than.

When real property valued and assessed as agricultural property is changed to a use other than agricultural it is subject to additional taxes referred to as rollback taxes. 2021 brings an update to South Carolina rollback tax laws with. Greenwood SC 29646-2634 Or fax to 864-942-8660 Or email assessorgreenwoodscgov NOTE.

It is the responsibility of the purchaser and seller to agree upon whom is responsible for the. Anytime a property changes its use from agricultural use to any other use it causes rollback taxes to be assessed. What are rollback taxes.

The market value for these 10 acres is 20000 and the agricultural value is 3120. The start of a new year frequently includes new or updated statutes and South Carolina is no exception. South Carolina General Assembly 123rd Session 2019-2020.

Maybank III Member at Nexsen Pruet LLC When agricultural real property is applied to a use other than agricultural it becomes subject to rollback taxes. What are rollback taxes. Calculation of Rollback taxes For example.

The difference is multiplied by the millage rate in the appropriate district and that results in the amount of tax due. A rollback tax is collected when properties change from agricultural to commercial or residential use. Please note a zero can be entered if no values apply.

Rollback Taxes In South Carolina Changes Effective January 1 2021 Burr Forman

Seneca Homes For Sale Seneca Sc Real Estate Redfin

Tax Liens And Your Credit Report Lexington Law

Amazon Com Stick The Irs Board Game The Tax Shelter Game Toys Games

South Carolina Benefits Of Fee In Lieu Of Tax Agreements

Roll Back Tow Trucks For Sale In Virginia 31 Listings Truckpaper Com Page 1 Of 2

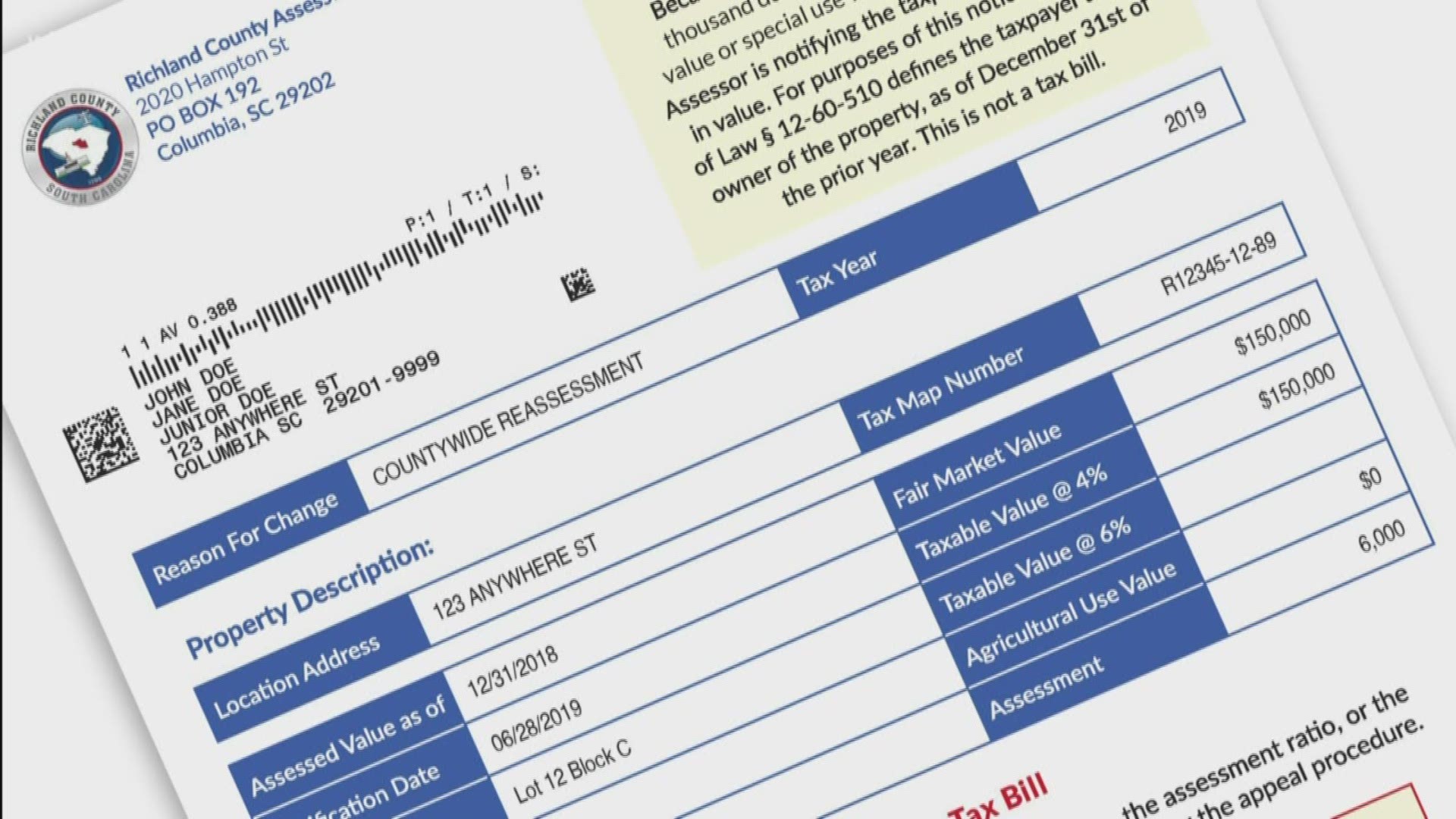

2019 Richland County Property Tax Reassessment Notices In The Mail Wltx Com

Tax Free Weekend In South Carolina Kicks Off Aug 5

Sc Legislature On The App Store

South Carolina State Tax Software Preparation And E File On Freetaxusa

Property Tax Increases Adopted In Towns Cities Across Charleston County News Postandcourier Com

The End Of Prosperity How Higher Taxes Will Doom The Economy If We Let It Happen Laffer Arthur B B 9781416592396 Amazon Com Books

Spirits Industry Pushes For States To Lower Taxes On Canned Cocktails

Real Estate Property Tax Data Charleston County Economic Development

North Carolina Tax Reform North Carolina Tax Competitiveness

International Roll Back Tow Trucks For Sale 96 Listings Truckpaper Com Page 1 Of 4

South Carolina Tax Deadline Extended Due To Coronavirus Wltx Com